Do you have Auto, Home, Motorcycle, Commercial, Business or other Insurance needs? We Can Help.

Home Insurance

Dwelling coverage.

Pays to repair or rebuild your home – including electrical wiring, plumbing, and heating and air conditioning – if damaged by a covered cause of loss. It’s important to buy enough dwelling coverage to cover the cost to rebuild.

Other structures coverage

Pays for damages to detached structures like garages, sheds, fences, and cottages on your property.

Personal property coverage

Reimburses you for the personal items in your home that may be damaged or destroyed by a covered cause of loss, which could include your furniture, clothes, sporting goods, and electronics.

Loss of use coverage

Pays your additional housing and living expenses if you must move out of your home temporarily while it’s being restored.

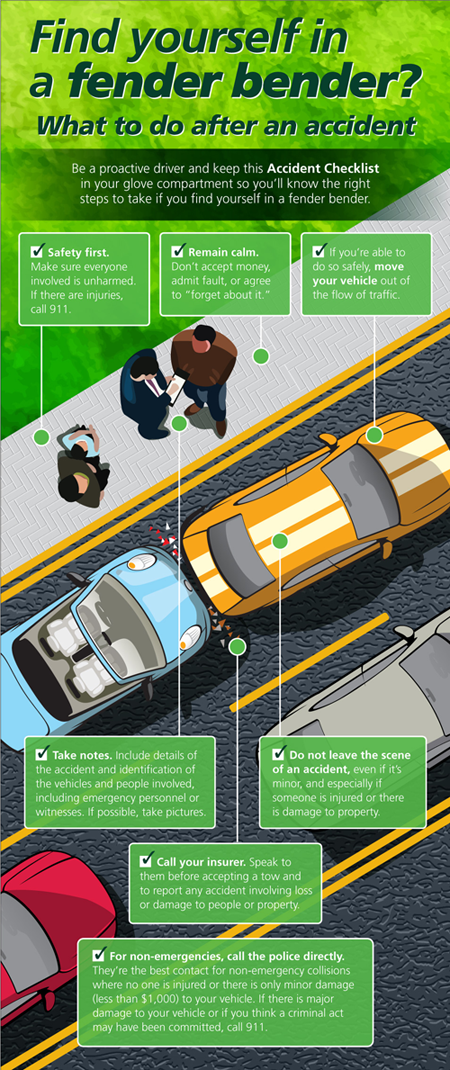

Liability insurance

Helps protect your assets and cover your defense costs in the event of a lawsuit because you or your family members are responsible for causing injuries or damage to other people or their property.

Auto Insurance

Bodily Injury Liability

This coverage applies to injuries that you, the designated driver or policyholder, cause to someone else.

Medical Payments or Personal Injury Protection (PIP)

This coverage pays for the treatment of injuries to the driver and passengers of the policyholder’s car. At its broadest, PIP can cover medical payments, lost wages and the cost of replacing services normally performed by someone injured in an auto accident. It may also cover funeral costs.

Property Damage Liability

This coverage pays for damage you may cause to someone else’s property.

Comprehensive

This coverage pays for damage to your car resulting from a collision with another car, object or as a result of flipping over.

Collision

This coverage reimburses you for loss due to theft or damage caused by something other than a collision with another car or object, such as fire, falling objects, missiles, explosion, earthquake, windstorm, hail, flood, vandalism, riot, or contact with animals such as birds or deer.

Uninsured and Underinsured Motorist Coverage

This coverage will reimburse you, a member of your family, or a designated driver if one of you is hit by an uninsured or hit-and-run driver.

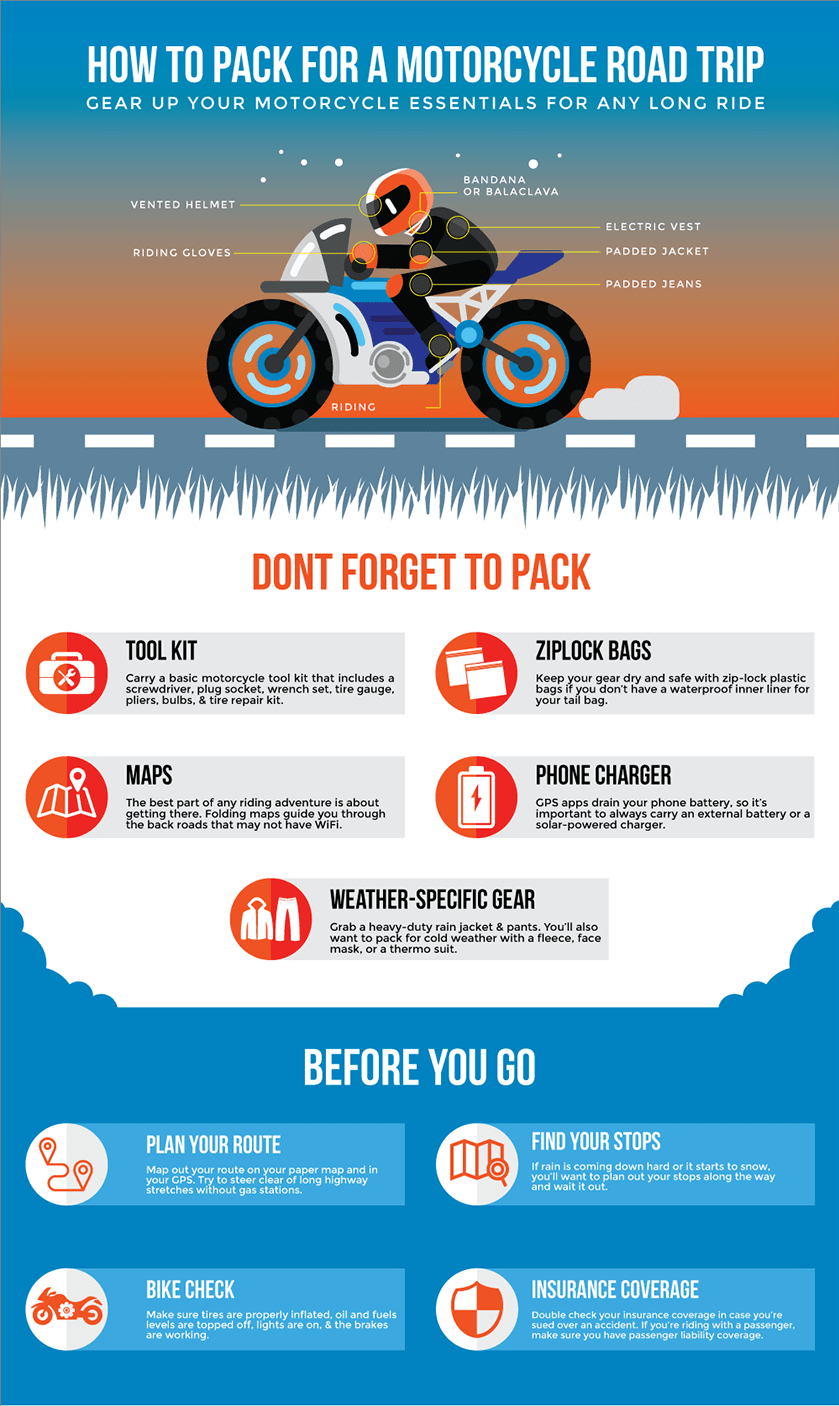

Motorcycle Insurance

Bodily Injury Liability

If you cause an accident and someone is injured, this motorcycle insurance coverage can help pay their medical bills and loss of income.

Property Damage Liability

This coverage helps pays for damages to another person’s vehicle or property, if you cause an accident.

Collision

Collision pays for damage to your vehicle if you hit another vehicle or object, another vehicle hits you, or your vehicle rolls over.

Comprehensive

Also known as “other than collision,” this motorcycle coverage can help pay for damage to your vehicle from vandalism, theft, weather events, and falling objects.

Uninsured Motorist

Helps protect you and your vehicle from uninsured drivers and hit-and-run accidents.

Underinsured Motorist

Helps protect you from drivers who do not have enough insurance to cover the costs of an accident.

Medical Payments

Also known as Personal Injury Protection (PIP), med pay can help cover medical costs related to an accident, regardless of who’s at fault.